For Those Who Seek Deeper: The Rise of DeepSeek

How?

“It’s just a side project. I call it DeepSeek.”

That’s how it began—what was supposed to be a small experiment to keep idle GPUs busy has turned into a global shake-up. DeepSeek didn’t just dethrone ChatGPT; it redefined the AI game.

The AI race between the U.S. and China isn’t new. Back in 2021, the Harvard Kennedy School Belfer Center predicted that if trends held, China could surpass the U.S. in AI leadership by the end of the decade. DeepSeek feels like a glimpse of that future, arriving ahead of schedule.

The Backstory: From Trading to Transforming

DeepSeek’s roots trace back to 2015, when three engineers at a Chinese university launched a hedge fund called High-Flyer. Their focus? Algorithmic trading powered by machine learning. It was niche, technical, and ahead of its time.

By 2020, they had scaled into a major player, launching Fire-Flyer I—a supercomputer with 10,000 NVIDIA A100 GPUs—and doubling down with Fire-Flyer II in 2021.

At that time, AI wasn’t mainstream. There was no ChatGPT, no LLaMA, no MidJourney. Just an ambitious trading firm quietly building cutting-edge infrastructure.

Then came 2023. OpenAI dropped ChatGPT, captivating the world. In response, High-Flyer announced a pivot: they were forming a new division focused not on trading, but on general AI research.

AI’s Sputnik Moment

DeepSeek R1 recently caused a stir by slashing costs for startups by 98% while maintaining (and even improving) quality. As one company put it:

“We’re now paying $0.55 per million tokens instead of $15. That’s a 98% cost reduction.”

The real-world impact?

Increased task accuracy by 22%

Scaled startup onboarding capacity by 2x

Reduced average time to first investor meeting

But what’s more interesting is the larger picture.

How Did DeepSeek Get Here?

China has cracked a formula that’s impossible to ignore:

Fund the best talent.

Locally: The government has poured resources into STEM education, creating a massive pipeline of engineers, data scientists, and researchers. Universities like Tsinghua and Peking University rank among the best globally in AI and machine learning research.

One of China’s greatest strengths lies in its commitment to funding collaborative research. The data speaks volumes: 79.3% of disclosed research funding instances in the analyzed corpus come from China, far outpacing Europe, the U.S., and the rest of the world.

It makes me wonder—what would a similarly ambitious strategy look like in the West?

Internationally: Thousands of Chinese students are sent to study at leading Western institutions, where they gain cutting-edge knowledge before returning home. Additionally, programs like the "Thousand Talents Plan" actively attract Chinese scientists working abroad to bring their expertise back.

Borrow, copy, and refine anything emerging from the West.

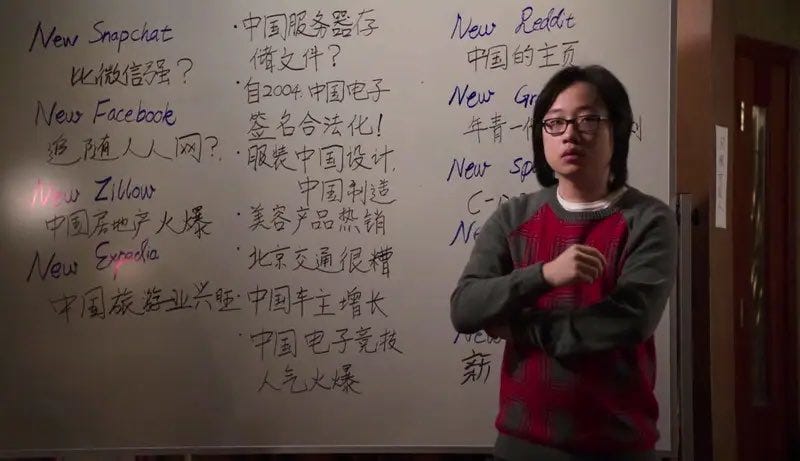

Social Media: TikTok learned from Western platforms like Vine, Snapchat, and Instagram but scaled faster and introduced features like hyper-personalized algorithms, making it wildly successful.

Electric Vehicles: Companies like BYD and NIO studied Tesla’s blueprint but focused on affordability and local market adaptation, enabling them to dominate EV markets.

AI Models: DeepSeek itself borrows the transformer-based architecture OpenAI popularized with GPT. However, it has refined this by optimizing for cost and resource efficiency, delivering similar performance at a fraction of the development cost.

Add relentless engineering and scale with cheap labor.

Efficiency: Chinese companies are known for their speed and resourcefulness in engineering, often achieving results faster than their Western counterparts. DeepSeek, for instance, developed three competitive AI models in one year—something OpenAI achieved over three years.

Labor Advantage: With access to a vast, cost-effective workforce, China can scale operations in ways that Western companies often struggle to replicate. This includes everything from software engineering to hardware manufacturing.

Distribute for free or at extremely low cost.

Loss Leaders: Chinese companies are willing to take short-term losses to build long-term market dominance. For example, DeepSeek’s R1 API costs $0.55 per million tokens, compared to OpenAI’s $15. This price disparity is a deliberate play to attract customers and erode competitors’ market share.

Accessibility: Lower pricing ensures wide adoption, particularly in emerging markets or among budget-conscious startups that can’t afford expensive Western tools.

Build a user base.

Network Effects: Platforms like TikTok and WeChat benefit from their massive user networks, creating a feedback loop where growth attracts more users.

AI Advantage: In AI, more users mean more data. And in the AI game, data is the ultimate competitive advantage. DeepSeek’s early adoption by startups provides it with real-world data that it can use to further optimize its models.

Dominate the market.

Ecosystem Lock-In: Companies integrate their products deeply into their users’ workflows, making it harder for them to switch to competitors. For instance, if a startup builds its operations around DeepSeek’s API, migrating to OpenAI later becomes costly and time-consuming.

Crowding Out Competitors: By flooding the market with affordable and efficient alternatives, Chinese companies force competitors to lower their prices or lose market share. This pressure can cripple smaller rivals.

What’s next? Robotics? As one tweet put it:

“They got Boston Dynamics’ robots doing backflips in three days while the U.S. struggled for decades.”

What DeepSeek Tells Us About the AI Race

DeepSeek’s rise is a reminder that innovation isn’t just about resources—it’s about efficiency. While OpenAI iterated through multiple models (Ada, Babbage, GPT-3.5, GPT-4, etc.), DeepSeek released three competitive models in a single year.

Their latest, DeepSeek R1, delivers performance comparable to OpenAI’s GPT models but at a fraction of the cost. It’s not perfect (I still think OpenAI’s top models have an edge), but the speed and cost-efficiency are remarkable.

Western analysts are calling this a "Sputnik Moment" for AI—a wake-up call that the gap between China and the West is narrowing, fast.

A Changing Landscape

DeepSeek isn’t just a competitor; it’s a catalyst. The AI race is heating up, and the game is changing. As one observer noted:

“Throwing a missile at OpenAI’s office wouldn’t hurt them as much as DeepSeek does.”

Are we ready for this shift?

👉 Learn more about the app: DeepSeek R1 for Everyone

#DeepSeek #AI #Innovation #ChinaTech